For everyone following along at home: this website is worth a click if you’ve never seen it before!

- 43 Posts

- 677 Comments

Rinsing rice does wonders. Without a rice cooker you’ll need to strain it, but it’s still worth it.

- Measure rice by volume. Let’s say 2 cups worth

- Put into fine colendar and rinse until the water comes out clear. Mixing with your hand will speed this up. You can also do this in the pot you’re going to cook in and dump water out

- Put strained rice in your pot

- Add cold water. The ratio of water to rice matters a lot and varies by species of rice. The ratio will be printed on whatever container your rice came in. For Jasmin rice it’s 2 water to 1 rice, so for our two cups of rice you’ll need 4 cups of water

- Cover, turn on medium-high heat, being to boil. Don’t go far because it will boil over when it does boil

- Turn the heat down to low, crack the lid, and set a timer. The amount of time needed will vary based on rice. For Jasmin, 15 minutes is a good check-in time

- Pop the lid. See water bubbling up? If yes, replace lid and come back in a few minutes. If not, use a wooden spoon to get a peek at the bottom of the pot. See water? If yes, replace lid and come back fairly soon to check again. If not, your rice is done. Turn the heat off, fluff, enjoy.

We made rice for years using this method and it is a very reliable cooking method. Rice doesn’t really leave you a lot of wiggle room though, which is where a rice cooker comes in handy. As an added bonus, some rice cookers come with water lines in them. I measure my dry rice into the cooker, rinse using the cooker, dump most of the water out, and fill to the appropriate level.

Different species of rice have very different textures and somewhat (subtle) different flavorss.

Some rice, like basmati, can be cooked using the pasta method (intentionally use way too much water and strain the excess off after the rice is cooked). I guess all rice could be cooked that way, but you would be giving up some starch.

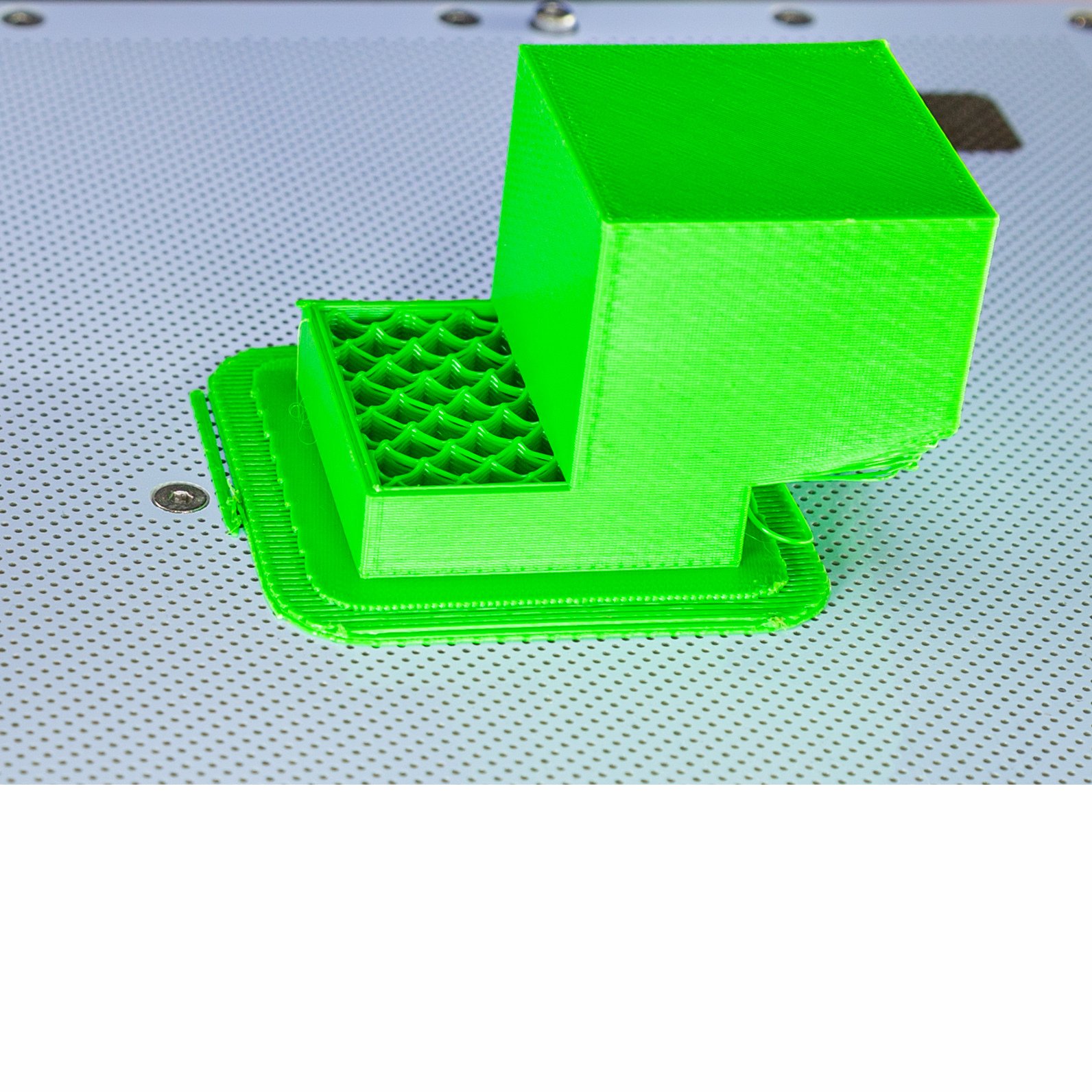

If the print didn’t come off the bed, I don’t think adjusting z-offset will help. As prints get taller, if you’re running into issues with warping the corners will start to curl up.

Your printer definitely missed some x or y steps. Whether that was due to your drivers getting too hot and just that, or the extruder running into the print. Have you ever seen your printer do this:

How did you remove the pineapple last year? Cut the whole stalk off at the plant , right below the pineapple, something else?

It looks like you missed some x and/or y steps, which made the printer lose its orientation and make a lot of spaghetti.

Possible causes usually involve warping, the nozzle catching the wrapped up piece, and then your printer missing some steps.

Have you completed a large print before?

3·3 days ago

3·3 days agoOne other thought that occurred to me overnight: you might be asking about FIRE (financial independence, retire early). There are tons of strategies for going about that.

I would caution about moving toward “off grid” type scenarios. Your monthly costs will be less, but you will have significantly higher up front (if buying a new residence) and/or maintenance costs (if buying used and/or when you decide to sell). For example, our water and sewer bill is around $800/year. If anything outside the house fails, the utility company will fix it. My in-laws sold a home in NJ with well water and septic and had to replace their sceptic field before they were able to sell. That set them back somewhere between $30k and $40k. Depending on your goals it could be either an advantage or a disadvantage.

5·3 days ago

5·3 days agoFeedback: your actual questions start about 2/3 down your post. Lead with them next time so we know how to answer better :)

it’s really hard to apply my city-living experience to try to extrapolate what life might be like if I make a goal to buy a small home in Nowheretown, USA to retire in 20 years down the line

We have younger kids, live in a lower cost of area, and bought our house in 2011. Excluding frivolous categories, our top expenses are:

- Saving for our retirement. Between our 401ks and IRAs, this is our biggest expenditure by quite a bit

- Food. We don’t eat out a ton, but also don’t do a great job of eating low cost. Feeding four is also fun, we can’t wait until they’re teens. This category is not much ahead of #3 though

- Our mortgage (it’s a 30 year and taxes, insurance, principal, and actual mortgage are $1,250/mo)

- Saving for our kid’d potential college tuition

Once the kids are out and we’re retired categories #1 and #4 go away, category #2 will probably get cut in half, and our taxes and insurance are currently well under $4,500/year. Speaking of taxes, mine are capped at a maximum increase of 5% or inflation, whichever is lower. With the housing run-up this has worked out in our favor.

Home expenses are a thing. It’s hard to say how much to budget for that though. Some of it depends on you (eg do you really need to renovate that bathroom in full), your taste, and your budget. I would expect a decent outlay every 5 years or so - roof, brick/siding/exterior work, furnace/ac, driveway etc. The more you’re willing and able to do yourself the better off you’ll be.

You don’t have to be in the boonies to live in a low cost of living area.

3·3 days ago

3·3 days agoIf nothing’s changed since you last print, including the filament, I would suspect a jam/clog. Is the extruder clicking?

lol, missed it 😂

1·4 days ago

1·4 days agoThanks for new and fresh vs old favorite! I posted something similar further down, will be sure to check this out.

4·4 days ago

4·4 days agoLet’s skip favorite and instead answer fun find that I’ve come back to a few times: Brothers of Metal - Kaunaz Dagaz (it is in English, lol). It’s viking metal, and as went through highschool with Blind Guardian and Rhapsody, it’s great to find bands still making banging fantasy metal https://music.youtube.com/watch?v=Nzad__XGDbQ&si=atuCBlgpMSQ9UkRL

I’ve also been a fan of Bloodywood lately. Think an angrier Hybrid Theory Lincoln Park, but from India and with some fusion going on. Machi Bhased is a good toe in the water https://music.youtube.com/watch?v=3kLKYWDQVec&si=xsmCHcr6llZdaAWc as is Dana-Dan: https://music.youtube.com/watch?v=uo6OC34QjY0&si=6SxQ6T9MwvRUdlJF

I’m guessing I’ma green bean that was left to fully mature. Let the green hulls dry out, shell the dry ones like any other bean, and cook them!

2·4 days ago

2·4 days agoArm band! I have a generic one I got on Amazon and it’s been very handy. It does slowly slide down my arm over 45 minutes or so, but I don’t really know how anything else would do better without being even tighter or having a more grippy material that I don’t really want again my skin.

11·5 days ago

11·5 days agoI wonder how they calculated the range. If it’s representative of the real world drive cycle these will experience, the estimate might not be too far off. A postal route is constant low speed stop and go. Regen is much more effective at higher speeds, so they’re probably dumping most of their kenetic energy to hear via friction brakes. Suspect their drive cycle is going to be something like an endless cycle of 25 kw acceleration, rest, 25 kw acceleration, rest, etc.

I am somewhat tempted to sign up and give it a shot. DDG is pretty solid for me, but it would be interesting to try a search engine where I’m not the product, it is.

If the biggest portion of your bill is AC and you live in a hot area the only things I could think of are planting some trees if they’ll grow and using a programmable thermostat to shift your usage away from off peek as best you can.

It was mostly for our younger kids. We live in a smaller ranch, so we close their doors after they’re asleep so we don’t have to worry about waking them up. This made one of their rooms a bit warmer In the summer and a bit cooler in the winter.

I should probably try balancing the ducts to compensate and might do that this winter.

Look up “home energy monitor”. They install inside your panel. The one we have has a bunch of current clamps, but not enough for our huge panel, so I chose what I thought our more heavily used circuits were. It also measures line voltage. Voltage x current = bingo. I’m not completely sure how I feel about the one I bought, so I’m not going to call it out. I wish it flagged trends per circuit over time to catch things like failing appliances. I could root it and mod it, but it would be nice if it did it out of the box. Catching a failing appliance would more than pay for the device, even if you do it by hand by simply tracking the data. It has slightly changed our habits (see: the furnace blower that we left on all the time and was pulling a constant 500 watts aka 12 kwh/day aka 360 kwh/mo), but I wouldn’t expect to find anything crazy unless you have high usage.

At least (some of us) are getting money back, when your solar production exceeds your consumption. But that is going to change soon.

The same thing is happening in the US. Solar panels used to be a lot more expensive to install, but the amount many utilities would pay your for excess generation was also a lot higher.

If it’s heat it could also be a cooling thing. If you search the web on your search engine of choice for “<printer name> driver overheat” you’ll see what solutions the community has already come up with.